Iraq is taking a major step to transform its financial landscape with the launch of the National Strategy for Financial inclusion 2025-2029, by the Central Bank of Iraq. Currently, only around 11% of Iraqis hold bank accounts or digital accounts, underlining the urgent need to expand financial access across the country.

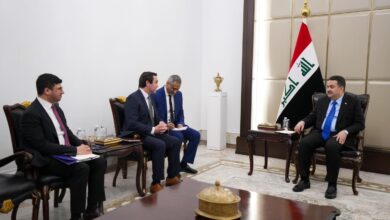

Backed by Germany, and international partners including, TAEUFIQ, Arab Monetary Fund and the German Agency for International Cooperation (GIZ), the Central Bank has unveiled this comprehensive strategy aimed at significantly improving financial inclusion by 2029.

To support the strategy, Iraq is undergoing complete banking reforms aimed at modernising the banking sector. They focus on enhancing financial transparency, governance and accountability.

Key objectives include improving financial services for all including small businesses and those most in need, promoting modern electronic payment methods and developing financial infrastructure and regulations.

The new strategy represents a crucial milestone for Iraq, setting the foundation for a more inclusive and strong economy. By widening access to banking and digital finance, the country aims to empower its citizens, stimulate entrepreneurship, and foster sustainable growth. Ambassador of the European Union, Mr Thomas Sellers emphasised the importance of this initiative, stating “Financial participation is an essential condition for development.”

With a strong focus on innovation, education, and consumer protection, Iraq’s National Strategy for Financial Inclusion 2025–2029 is set to transform the way Iraqis engage with their financial system opening the door to greater economic opportunities for all.

Sources: German Embassy Baghdad , GIZ

- Published: 28th May, 2025

- Location: Baghdad

- Country: Iraq

- Editor: Nour Ghanem

- Category: Business